SEBI Bars Jane Street Amid Market Turbulence: An In-Depth Analysis

In a significant move aimed at maintaining market stability, the Securities and Exchange Board of India (SEBI) recently imposed a ban on the American trading firm Jane Street Capital and its associated entities. This decision comes during a period of heightened volatility in the Indian stock market, leading to considerable turmoil among investment firms.

Table of Contents

ToggleUnderstanding SEBI’s Ban

SEBI‘s ban is primarily rooted in allegations of market manipulation. The regulatory body accuses the trading firm of using illicit strategies to inflate index levels, thus realizing substantial profits from index options.

Key Reasons Behind SEBI’s Intervention

- Manipulative Trading Practices: Allegations include profiting excessively from manipulated index options.

- High Revenue During Turbulent Periods: The Jane Street group reportedly gained over ₹43,289 crores from such transactions from January 2023 to March 2025.

Impact on the Indian Share Market

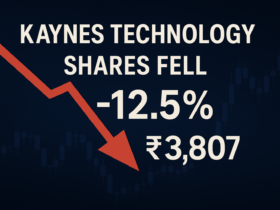

The immediate aftermath of SEBI’s action has been a drastic decline in the share prices of several brokerage firms.

Noteworthy Stock Declines

| Indian Shares | Share Price Decline | New Share Price |

|---|---|---|

| Nuvama Wealth Management | 11% | ₹7,280 |

| BSE | 7% | ₹2,613 |

| Angel One | 7% | ₹2,734 |

| Central Depository Services Ltd. | 4% | ₹1,726 |

Market Response and Future Projections

The market reaction to this ban reflects concerns over market integrity and investor sentiment.

- Stock brokerage firms are feeling the heat, with significant losses recorded in their stock values.

- Investors are advised to remain cautious amid unfolding events and potential regulatory changes.

What Does This Mean for Traders?

- Intraday Trading: Traders might want to adjust their strategies to mitigate potential risks.

- Option Trading: The ban can lead to increased scrutiny on how options trading is conducted in India.

Conclusion

SEBI’s intervention is a critical reminder of the need for regulatory oversight in financial markets. As the Indian share market reels from this decision, stakeholders must assess their positions carefully. Staying informed can provide a strategic advantage.

For timely updates on stock market developments, subscribe to our newsletter. Stay informed, stay ahead!

Leave a Reply