improve your financial knowledge

Stock market books

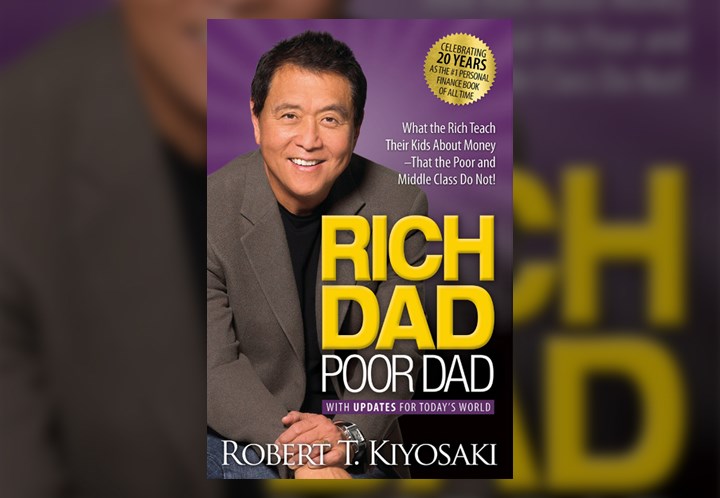

Rich Dad Poor Dad: Overview & Benefits

A quick look at Robert Kiyosaki’s classic personal finance guide.

Rich Dad Poor Dad, authored by Robert Kiyosaki, contrasts two financial mindsets: the traditional path of job security (Poor Dad) and the wealth-building approach of entrepreneurship and investing (Rich Dad). It reshaped how millions think about money and independence.

Key Lessons

1. Financial Education Matters

Understanding money and assets is more powerful than formal degrees alone.

2. Assets vs. Liabilities

Assets put money into your pocket; liabilities take it out. The rich focus on building assets.

3. Build Passive Income

Investments in real estate, stocks, or businesses generate income beyond a paycheck.

4. Embrace Risk

Failure is a teacher. Avoiding fear leads to smarter financial choices.

5. Wealth Mindset

See opportunities where others see obstacles.

Stocks to Riches: Overview & Key Takeaways

A concise guide to growing wealth through disciplined stock investing.

Stocks to Riches focuses on the principles of investing in equities to build long-term wealth: buy quality businesses, use discipline, diversify, and let compounding and time do the heavy lifting.

Core Principles

1. Invest for the Long Term

Stocks reward patience—time in the market beats timing the market.

2. Focus on Quality Businesses

Seek companies with durable competitive advantages, healthy cash flow, and strong management.

3. Diversify & Manage Risk

Spread investments across sectors and use position sizing to control downside.

4. Use Dollar-Cost Averaging

Regular, automatic investments reduce timing risk and build wealth steadily.

5. Keep Emotions in Check

Avoid panic selling; follow a written plan and review periodically.

The Intelligent Investor: Key Ideas & Benefits

A concise summary of Benjamin Graham’s classic on value investing and risk management.

The Intelligent Investor by Benjamin Graham (with commentary by later editors) teaches value investing fundamentals: focus on intrinsic value, apply a margin of safety, treat the market as a servant not a guide, and prioritize long-term discipline over short-term speculation.

Core Principles

1. Margin of Safety

Buy securities at a significant discount to intrinsic value to limit downside risk.

2. Mr. Market

See market prices as opportunities—sometimes irrational—rather than strict guidance.

3. Defensive vs. Enterprising Investor

Define your approach: conservative (diversified, low-maintenance) or active (selective, research-driven).

4. Long-Term Discipline

Patience and a written strategy outperform emotional trading.

5. Focus on Fundamentals

Analyze earnings, balance sheets, and cash flow; avoid price-only decisions.