Table of Contents

ToggleIntroduction

Recently, U.S. President Donald Trump announced a significant increase in tariffs on Indian imports, particularly focusing on Russian crude oil. This move has sparked widespread discussion about its potential repercussions for the Indian stock market, trade flows, and overall economic outlook.

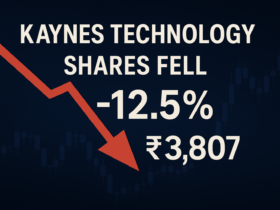

Effects on the Indian Stock Market

The tariff hike raises the total U.S. duty burden on Indian exports to 50%. Export-focused sectors like IT services, textiles, and pharmaceuticals face heightened challenges. Immediate market response could see indices dip by 1-2%. If tariffs persist a year, analysts estimate a 30-40 basis point drag on India’s GDP.

Sectoral Impact

- Textiles, Gems & Jewelry, Auto Components: Likely to see the highest pressure from new tariffs.

- Pharmaceuticals, Electronics: May be partially or fully exempt, offering some relief for diversified investors.

Investment Strategies

In times of geo-economic uncertainty, a balanced yet proactive approach is vital:

- Reduce exposure to sectors with high U.S. export risk in the short term.

- Watch for corrections—market drops exceeding 5% may create attractive entry points for strong Indian companies.

- Maintain a long-term outlook focused on India’s structural growth. Temporary volatility can offer buying opportunities rather than signal doom.

Leave a Reply