Table of Contents

ToggleUPI Breaks Record: Unleashing India’s Digital Payments Power

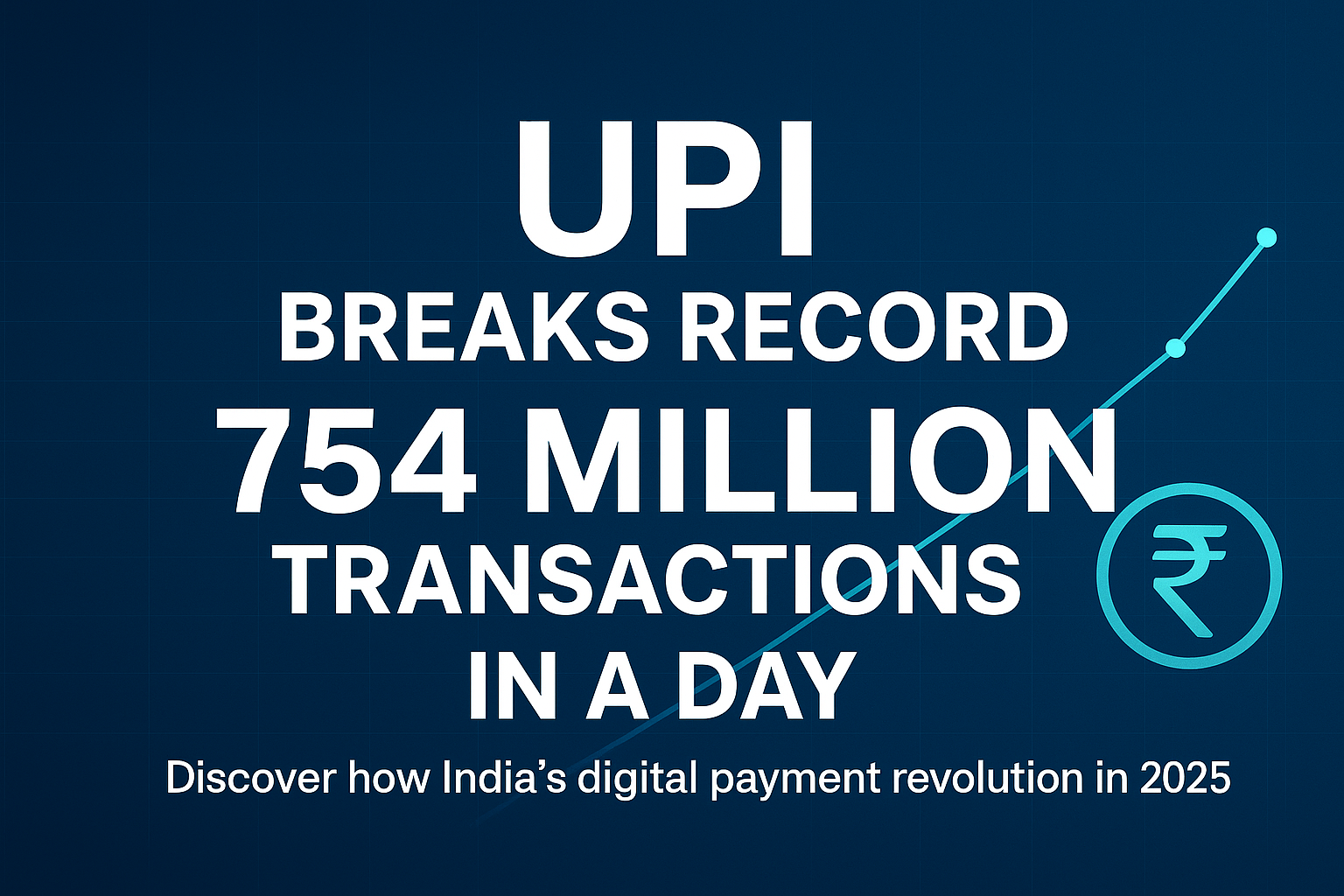

India’s Unified Payments Interface (UPI) has shattered yet another milestone, demonstrating the country’s unprecedented digital transformation in the financial sector. The revolutionary payment system has not only transformed how Indians transact but has also positioned the nation as a global leader in digital payments innovation.

Record-Breaking Numbers

UPI transactions have reached astronomical figures, processing billions of transactions monthly with values exceeding previous records. This remarkable growth showcases the deep penetration of digital payments across urban and rural India, making cashless transactions accessible to millions of users.

The Technology Behind UPI

Built on robust infrastructure by the National Payments Corporation of India (NPCI), UPI enables instant real-time payments through mobile platforms. The system’s architecture allows seamless integration across multiple banking platforms, creating an ecosystem where users can transact effortlessly using just their mobile phones.

Impact on Financial Inclusion

UPI’s success extends beyond mere transaction volumes. It has democratized financial services, bringing banking to the unbanked and enabling small businesses to accept digital payments without expensive infrastructure. This transformation has accelerated during the post-pandemic era, where contactless payments became not just convenient but essential.

Global Recognition

International markets are taking notice of India’s UPI model, with several countries exploring similar systems. The success of UPI has established India as a fintech powerhouse, attracting global attention and investment in the digital payments sector.

Future Prospects

As UPI continues to evolve with new features like credit on UPI and international expansion, the platform is set to further revolutionize digital payments. The integration of emerging technologies promises to make transactions even more secure, faster, and user-friendly.

This record-breaking performance of UPI reflects India’s digital-first approach and positions the country at the forefront of the global fintech revolution. For investors and market observers, UPI’s growth trajectory offers insights into the immense potential of India’s digital economy.

Leave a Reply